Why Millennials in Hopewell, VA Shouldn’t Wait to Get Life Insurance

If you’re a millennial living in Hopewell, Virginia, life insurance might not be at the top of your to-do list. Between rent or a mortgage, student loans, and the rising cost of groceries, the idea of adding another bill may sound impossible.

But here’s the truth: life insurance is one of the most affordable and valuable financial tools you can own—especially when you’re young and healthy. The earlier you start, the more protection and value you lock in for yourself and your loved ones.

Let’s explore why millennials in Hopewell, VA should seriously consider life insurance now—and how working with a local life insurance professional can make all the difference.

Why Life Insurance Matters for Millennials in Hopewell

Hopewell is full of hardworking families and individuals building their futures—teachers, small business owners, tradespeople, and professionals commuting to Richmond or Fort Gregg-Adams. If that sounds like you, here are a few key reasons why life insurance is essential.

1. You Can Lock in Low Premiums While You’re Young

Life insurance prices are based on age and health. That means the younger and healthier you are, the cheaper your policy will be.

Buying coverage in your 20s or 30s lets you lock in rates that stay the same for decades—saving you hundreds (or thousands) over time.

2. Protect the People Who Depend on You

Even if you don’t have kids yet, there may be people counting on you financially:

A partner or spouse

Elderly parents you help support

Co-signed student or car loans

A mortgage or joint lease

If something unexpected happens, life insurance helps your loved ones stay on their feet instead of facing financial hardship.

3. Cover Debts and Big Expenses

Millennials are the first generation to carry record levels of student debt—and those debts don’t always disappear if you pass away. Life insurance ensures your family isn’t left struggling to pay off your obligations.

It can also help cover funeral and final expenses, which can easily exceed $10,000 in Virginia.

4. Plan for Future Family or Homeownership

Many millennials in Hopewell are buying homes or planning to start families. A solid life insurance policy protects your home, your children, and your partner if you’re no longer around to provide income.

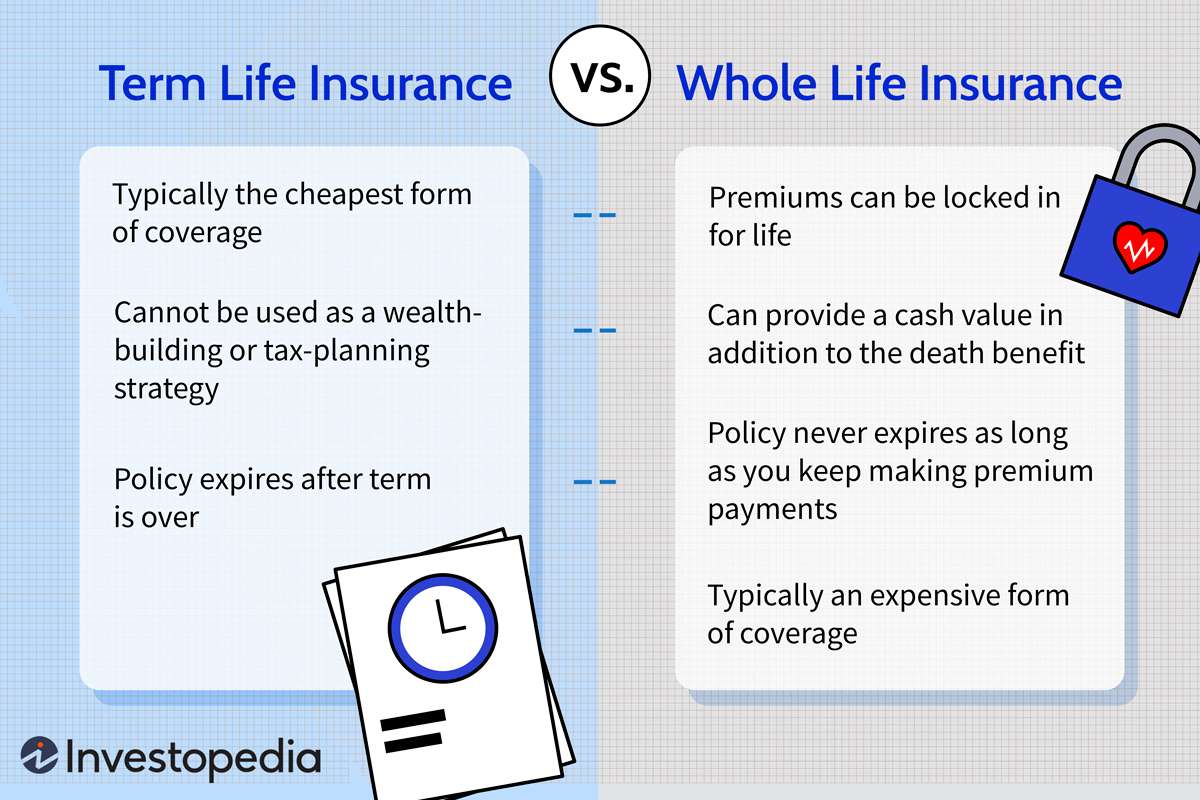

Understanding the Two Main Types: Term vs. Whole Life Insurance

Let’s break down the differences between term life and whole life insurance, so you can see which might fit your life stage and goals.

Term Life Insurance (Simple and Affordable)

Term life insurance covers you for a set period—usually 10, 20, or 30 years. If you pass away during that term, your beneficiary receives a tax-free payout.

Pros of Term Life:

Affordable: The lowest cost per $1,000 of coverage.

Straightforward: No savings or investment component—just pure protection.

Flexible: Choose a term that aligns with your biggest financial obligations (like your mortgage or raising kids).

Convertible options: Some term policies allow you to switch to permanent coverage later, without a medical exam.

Cons of Term Life:

Coverage ends when the term expires.

No cash value or investment growth.

Renewing later can be expensive if your health changes.

Best for: Millennials who want affordable, large protection during their highest earning and debt years.

Whole Life Insurance (Builds Value Over Time)

Whole life insurance provides lifelong coverage and includes a cash value component that grows over time, tax-deferred. You can even borrow against it later for emergencies or opportunities.

Pros of Whole Life:

Lifelong protection: Coverage never expires as long as premiums are paid.

Builds cash value: Acts like a built-in savings account you can access later.

Predictable growth: Many whole life policies guarantee cash value accumulation.

Legacy and estate benefits: Helps with wealth transfer or final expenses.

Cons of Whole Life:

Higher monthly premiums compared to term.

Cash value builds slowly in early years.

Less flexibility—canceling early can lead to penalties or loss of value.

Best for: Millennials who want to build wealth over time, protect loved ones for life, or leave a financial legacy.

Quick Comparison: Term vs. Whole Life

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | 10–30 years | Lifetime |

| Cost | Low | Higher |

| Cash Value | None | Builds over time |

| Best For | Income protection, debt coverage | Long-term wealth, final expenses |

| Flexibility | High (simple to manage) | Moderate (more structure) |

Which Type Fits Most Millennials in Hopewell?

For most millennials in Hopewell, term life is the ideal starting point. It gives you the coverage you need now—at a price that fits your budget.

Then, as your career and finances grow, you can add or convert to whole life insurance to build long-term value and ensure lifetime coverage.

This flexible “term first, whole later” strategy works especially well for young families, new homeowners, and small business owners in Hopewell who want protection today and stability tomorrow.

Why Work with a Local Life Insurance Professional in Hopewell?

You’ve seen the ads for quick online policies—but here’s the thing: life insurance isn’t one-size-fits-all.

Working with a local professional in Hopewell gives you an edge that online platforms simply can’t match.

1. Personalized, Local Guidance

A Hopewell-based agent understands your community’s cost of living, family structure, and income realities. You’ll get personalized recommendations—not cookie-cutter online quotes.

2. Help Navigating Options

Life insurance policies come with riders, conversion options, and underwriting rules that can get confusing fast. A professional can explain the fine print and make sure you don’t overpay.

3. Ongoing Support

When life changes—new baby, new home, or new job—a local agent can help you adjust your policy quickly. With a local expert, you have someone you can actually reach, not just a chatbot or call center.

4. Peace of Mind

You’ll have a real person advocating for you if a claim or billing issue ever arises. That’s the kind of security no online-only company can offer.

Life Insurance in Hopewell: A Smart Move for Your Future

Hopewell, VA, is a proud, close-knit community where families look out for each other. Protecting your loved ones financially is one of the best ways to honor that value.

Whether you’re a young teacher in City Point, a new homeowner near Patrick Copeland Heights, or commuting to Richmond for work, life insurance helps you build stability and peace of mind.

Ready to Protect Your Future?

You’ve worked hard to build your life—don’t leave your family’s future to chance.

Contact David Lewis Jr., your local Kemper Life agent in Hopewell, VA, to find the perfect plan for your needs and budget.

Click here to get started today:

https://www.inwebsitebuilder.com/dlewislifeagent